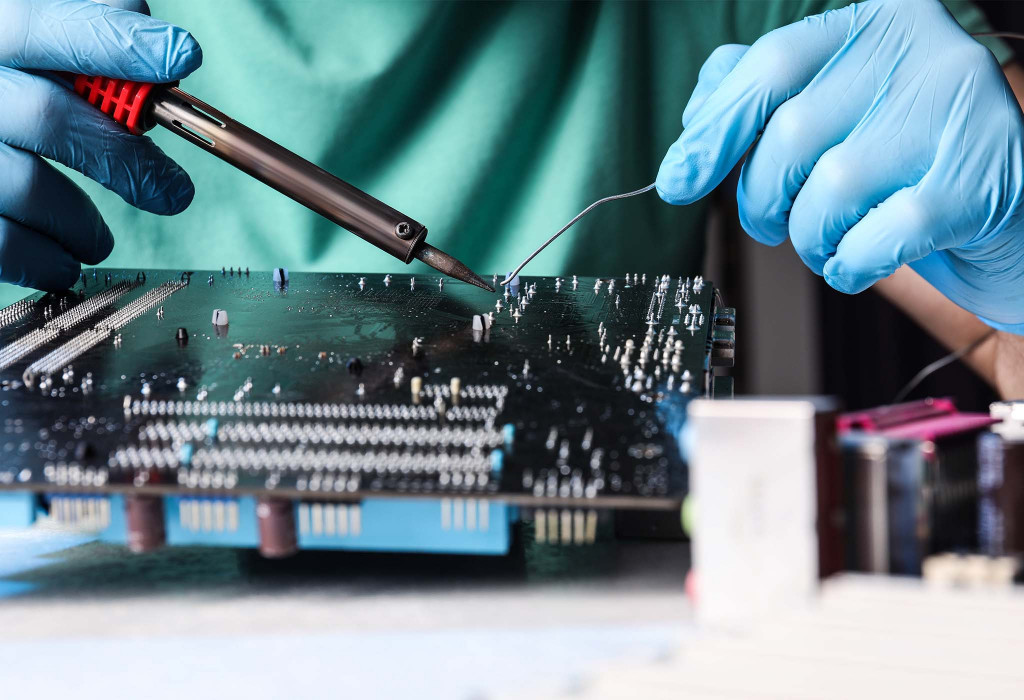

Electronics and Hi-Tech Claims

Your electronics or hi-tech company has suffered property damage. Your focus is getting your operations back up and running, instead of worrying about the insurance claims process – but going through with it is a necessary step to stay operational and recover. Our licensed public adjusters lift that burden off you and manage the insurance claims from start to finish. We evaluate and document not only the physical damage to your property, but also the income lost from business interruption.

How can I possibly put into words how much of a difference it made to have had Ken Crown, Chris Glenister and yourself guiding METROTECH Corporation through the complexities of the insurance policy, tedious negotiations and arcane legalities surrounding this event. You and your team surely increased our claim collections from Kemper by $1 to $2 million over what I could have done on my own.

-

1

You just suffered serious damage to your electronics or hi-tech store and you are wondering what to do next.

-

2

You call your insurance company and wait for an adjuster to come out, hoping that they will have your best interests at heart.

-

3

You move from the asset side of your insurance company's ledger to the liability side of their ledger.

We Can Help

Knowing everything you possibly can about the "fine print" of your insurance policy before you have any substantive dialogue with your insurer is an absolute necessity. Know what you are covered for and how to claim it. What you say to your insurance company's adjuster and how you say it can make a dramatic difference in how much you get paid. The more you know, the better the results.

Electronics & Hi-Tech Factors to Consider

Be sure to understand each of the following factors before engaging with the insurance company. Knowledge is the key to a successful claim outcome.

- What is my broker's/agent’s role?

- Does the adjuster work for us or the insurance company? Why they can't work for both. It's a conflict.

- Does the insurance company pay for professionals necessary to evaluate my claim? Are they working for me or them?

- Warranties and Protective Safeguard requirements. What do they mean? Can I still collect if I am not in full compliance?

- Is there coinsurance in my policy? What does it mean?

- Does my risk manager have the requisite skill sets to negotiate a large property claim?

- What happens when the insurance company engages a forensic accountant? Who does that accountant work for?

- How is actual cash value determined? Why should I care?

- Can I compensate employees who help with cleaning or restoration?

- Replacement properties. Lease purchase strategy. Is it good for me?

- Replacing versus repairing equipment/processing lines. Pros and cons.

- Is the insurance company using an independent building or equipment consultant to prepare a bid? Who are these consultants? Who are they working for? Do they only work for insurance companies?

- How quickly can I get started rebuilding?

- How does my policy address increased costs due to new codes? If my coverage is limited, what can I do about it?

- Should I have concerns as to how my insurer deals with pollutants - hazardous materials - lead & asbestos?

- What is the difference between a schedule of values and a schedule of limits?

- How do smoke and the water used to fight the fire affect my machinery? Equipment? Computers? Other electronics?

- Valuation of raw materials. Work in progress. Finished goods. Methodologies employed.

- Can I recast my financial statements? If so, why?

- Do I understand why coinsurance clauses in loss of income coverage can lead to disastrous results when including labor expenses in the cost of goods manufactured and exclude those labor expenses in the business interruption evaluation?

- Credit for continuing sales. How are they calculated?

- Can I continue to pay my employees?

- What is the difference between Actual Loss Sustained and Sales Value of Production and how does it affect my claim?

- What happens if I open my business elsewhere and I am successful? What if I am not successful?

- What are extra expenses? What can be included? Can I use extra expenses to offset shortfalls in property coverages?

- What are expediting expenses? How do they differ from extra expenses?

- How do I project lost sales? Sales declines?

- How do I project sales of new products?

- Can I use proformas/budgets to calculate loss of income?

- Increased efficiency and productivity with new equipment. Does the insurance company get a “credit?”

- Temporary facilities. Portables. Hardscape. Temporary or permanent? How presenting my story can affect my recovery. Do I know my policy provisions?

- Temporary production in other owned or non-owned locations? What happens at the end of my claim?

Electronics and Hi-Tech References

In addition to the 5,000+ references on our list, here are some well-known names in the electronics and hi-tech industries we have helped.

- American Telecommunications Corp. A General Dynamics Subsidiary

- Ametron Electronics

- Apic Yamada Corporation

- Athan Corporation

- Chin-Chan Chi

-

Countryman Associates

- E & M Electric & Machinery

- Fourth Dimension Work Systems

- Alan Gordon Enterprises

- Charles & Ardenne Gutentag

- Hardtimes Hardisk Technology

- Harris Corporation

- Interface Aviation

- ISC Electronics

- J & R Film Company

- La Curacao

- Mar Vac Electronics

- Metrotech Corporation

- Micrel Semi-Conducter

- Neasi-Weber International

- William R. O'Donnell (Member, Senate of Nevada)

- Payne Magnetics

- Polycore Electronics

- Rosenfeld, Meyer & Susman

- Ismael "Sam" Safaradi

- Joseph & Rosalie Sasson

- T. Louis Snitzer Company

- Sound Expressions

- Soundcoat Company

- Cliff & Linda Souza

- Technolite & Lighting West

- Top Bargain

- Vector Fabrication

The Difference Public Adjusters Make

We work exclusively for YOU, not the insurance company. Our insurance professionals have managed and negotiated thousands of claims for nearly every type of natural and man-made disaster. Local in our approach, we have over forty offices across the U.S. and Canada, and an unmatched network of expert resources to efficiently mobilize and be at your side.